MAKE YOUR NEXT MOVE WITH DANCO

Find Your Next Property

Your Next Chapter

Starts Here

Get the benefit of a full-service real estate agency experience that offers a 360° approach to helping you achieve your real estate goals.

For over a decade now, we have been dedicated to providing valuation services, property management, estate agency, real estate transaction advisory and real estate market intelligence gathering and feasibility studies.

Our Latest Properties

Be the first to browse exclusive listings before they hit the market.

Buy, sell, lease with ease.

Stressed about buying or selling? We take the wheel. Whether you’re seeking the perfect dream home or the ideal buyer for your cherished property, Danco navigates every step with expertise, dedication, and results.

Buy a property

Find your place with an immersive photo experience and the most listings, including things you won’t find anywhere else.

Rent a property

We’re creating a seamless online experience – from shopping on the largest rental network.

Sell a property

Sell your home with confidence Danco is making it simpler to sell your home and move forward. Partner with us today

Special deals

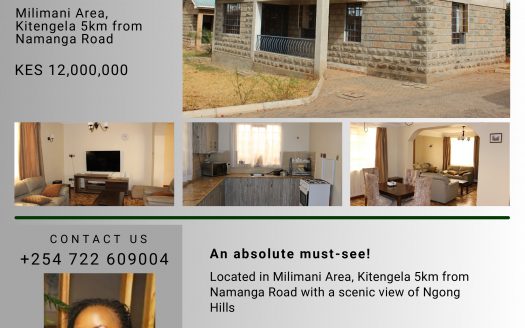

Our Featured Properties

Discover your dream property with a fully immersive photo experience. Get exclusive access to new listings before they hit the market.

We Are Experts In Real Estate

Our Services

Be smart about your real estate strategy at every stage of your journey. Lean on our experienced real estate experts to help you build a future you can be proud of with a registered and experienced real estate experts.

Valuation & Property Appraisal

Valuation and appraisal services form one of Danco's core multi-disciplinary offering to our clients. We offer valuation services to individuals, Banks, Saccos', law firms, parastatals, CBO's

Sales, letting and other agency services

Ready to buy or sell a property? We source for buyers on behalf of property sellers. Source for property on behalf of buyers. Property acquisition and long term lease negotiations.

Feasibility Studies

Danco delivers market analysis and insights that drive value ein real estate decisions and support successful strategies for our clients. . Our feasibility studies delve into factors like market demand, cost analysis, and potential risks to help you make informed decisions.

Property Management

Enhancing returns to our clients real estate investors is the priority in all Danco's engagements. Danco provides critical advice and management services to ensure optimal returns on investments

articles

Take a deeper dive into real estate insights & opinions

The latest Kenyan and international property market news and opinions, plus helpful guides and top tips from our renowned industry experts.